Structured settlement sales provide an intriguing route for individuals seeking quick access to capital from long-term financial arrangements. These settlements, often arising from personal injury cases, allow recipients to receive a steady income over time; however, circumstances may prompt them to consider selling these future payments for an immediate lump sum. Understanding the intricacies of structured settlement sales is crucial for making informed decisions, as it involves navigating a landscape of legal requirements, market dynamics, and potential financial strategies.

As we delve deeper, we shall explore the mechanics of selling a structured settlement, the market environment surrounding these transactions, the key players involved, and the legal and financial considerations that should guide any decision. This examination will shed light on both the benefits and drawbacks of selling, while also presenting alternative options for those considering this route.

Understanding Structured Settlement Sales

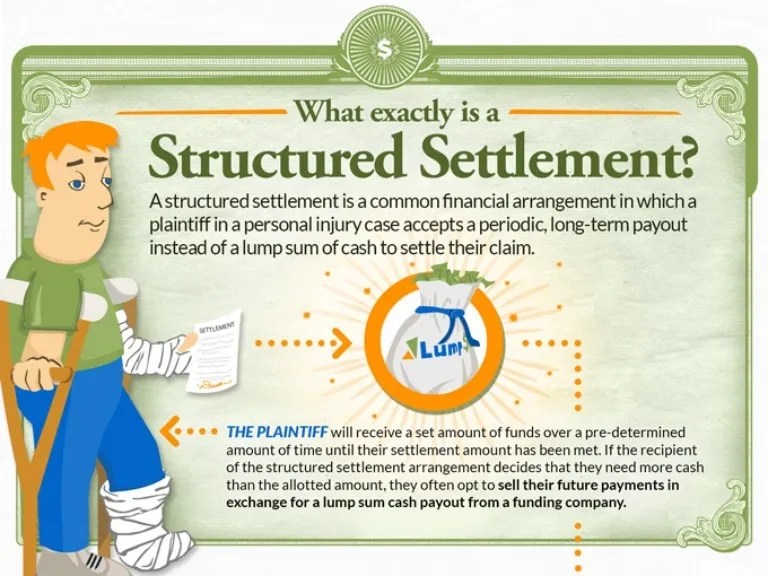

Structured settlements are financial arrangements that provide regular payments to individuals, often as a result of legal cases, such as personal injury lawsuits. This system is designed to ensure that the recipient has a steady income over time, rather than a lump sum, which can help with budgeting and long-term financial planning. However, there are circumstances where an individual may find it beneficial to sell their structured settlement for immediate cash, setting the stage for structured settlement sales.

The process of selling a structured settlement involves several steps. Initially, the seller must contact a buyer, typically a specialised company or financial institution, that purchases structured settlements. After expressing interest, the seller will undergo a thorough evaluation process in which the value of the remaining payments is assessed. Following this, the seller is presented with an offer, which they can either accept or decline. Should they accept, legal documentation is prepared, and court approval is often necessary, as structured settlements are usually protected by law to ensure that the seller’s needs and rights are safeguarded.

Benefits and Drawbacks of Selling Structured Settlements

Understanding the benefits and drawbacks of selling a structured settlement is crucial for individuals considering this option. While there are notable advantages, there are also potential pitfalls that must be acknowledged.

The benefits of selling a structured settlement include:

- Immediate Access to Cash: Selling a structured settlement provides immediate liquidity, allowing individuals to address urgent financial needs such as medical expenses, debt repayment, or significant purchases.

- Flexibility in Financial Management: With cash in hand, individuals can invest or allocate funds in a way that may better suit their current financial situation and future goals.

- Avoiding Future Uncertainties: Receiving a lump sum can provide peace of mind, especially in uncertain economic times, allowing individuals to take control of their financial destiny.

However, there are also drawbacks to consider:

- Reduced Total Value: Selling a structured settlement typically means the seller receives less than the total value of the future payments, as the buyer factors in their profit margins.

- Potential Legal Complications: The process often requires court approval, which can lead to added complexity and time delays.

- Unforeseen Financial Consequences: Access to a large sum of money can lead to poor financial decisions, such as overspending or unwise investments, which may jeopardise long-term financial stability.

It is essential for individuals to carefully weigh the immediate benefits of cash against the long-term implications of selling their structured settlements.

The Market for Structured Settlement Sales

The market for structured settlement sales operates within a unique niche, where the convergence of legal, financial, and personal factors shapes the landscape. As individuals seek liquidity from their long-term payment agreements, several elements can influence their decisions, as well as the dynamics of the market itself.

Key factors influencing the market for structured settlement sales include interest rates, the financial stability of purchasing companies, and regulatory changes. Interest rates play a pivotal role; when rates are low, the present value of future payments decreases, making it less attractive for sellers to offload their settlements. Conversely, high rates can bolster the attractiveness of lump-sum offers. Additionally, the financial health of the companies purchasing these settlements can impact consumers’ trust and willingness to engage in transactions. Moreover, changes in regulations governing structured settlements can either facilitate or complicate the selling process, affecting overall market activity.

Major Players in the Buying and Selling Process, Structured settlement sales

The structured settlement sales market is characterised by various entities that play crucial roles in the buying and selling process. Understanding these players is key to navigating the market effectively.

The primary players include:

- Structured Settlement Buyers: These are specialised firms that purchase structured settlements from individuals. They assess the value of future payments and offer lump sums in return.

- Legal Professionals: Attorneys often guide clients through the process, ensuring compliance with legal requirements and helping to negotiate fair terms.

- Financial Advisors: These professionals may assist clients by offering insights into the implications of selling a structured settlement versus retaining it.

- Insurance Companies: They are the original issuers of structured settlements and play a role in the transfer of these financial products during sales.

It is essential for potential sellers to engage with reputable buyers who can offer competitive rates and reliable service.

Comparison of Companies Purchasing Structured Settlements

In the realm of structured settlement purchases, various companies offer differing terms and conditions. Evaluating these offers is crucial for sellers to ensure they receive a fair deal.

When comparing companies, key aspects to consider include:

- Discount Rates: This refers to the percentage deducted from the total future value of the structured settlement. Companies like J.G. Wentworth and Peachtree Financial have been noted for competitive rates compared to smaller firms.

- Customer Service: The responsiveness and transparency of communication can greatly affect the selling experience. Companies with positive reviews, like Novation Settlement Solutions, typically provide better customer experiences.

- Closing Time: The duration required to complete the sale process can vary; some companies are known for expedited services, whereas others may take longer due to rigorous verification processes.

In summary, while numerous companies are engaged in purchasing structured settlements, their offers vary significantly based on discount rates, customer service, and efficiency. Evaluating these factors thoroughly can empower individuals to make informed decisions.

“The financial landscape of structured settlements is shaped by various influential factors, necessitating careful consideration by potential sellers.”

Legal and Financial Considerations: Structured Settlement Sales

Selling a structured settlement involves navigating a complex landscape of legal and financial requirements. It is essential for sellers to be fully informed about the legal stipulations governing such transactions, the tax implications that may arise, and effective strategies for negotiating favourable terms with potential buyers. This knowledge ensures that sellers can make informed decisions and avoid pitfalls that could result in financial loss.

Legal Requirements for Selling Structured Settlements

Engaging in the sale of structured settlements is governed by specific legal requirements that vary from jurisdiction to jurisdiction. Generally, the sale must be approved by a court, which is tasked with protecting the interests of the original settlement recipient. Sellers should be aware of the following key legal considerations:

- Court Approval: A seller must petition the court for approval of the sale, demonstrating that it is in their best interest.

- State Regulations: Different states have varying regulations regarding structured settlement sales, including specific forms and documentation required for the approval process.

- Disclosure Obligations: Sellers must provide full disclosure regarding the terms of the sale, including the amount being sold and any fees associated with the transaction.

Tax Implications Associated with Structured Settlement Sales

The tax treatment of structured settlements can be intricate, particularly when they are sold. Generally, structured settlements are designed to provide tax-free income. However, the sale may trigger tax liabilities. It is essential to understand the following points:

- Tax-Free Payments: Payments from a structured settlement are typically tax-free, provided they are received as intended.

- Capital Gains Tax: If a structured settlement is sold, the seller may be liable for capital gains tax on any profit made from the sale.

- Consult a Tax Professional: Given the complexity of tax laws, it is prudent to consult with a tax advisor to understand the specific implications of a sale on one’s tax situation.

Best Practices for Negotiating Terms with Buyers of Structured Settlements

Negotiating the terms of a structured settlement sale can significantly impact the overall outcome for the seller. Employing effective negotiation strategies can lead to more favourable terms and a better financial position. Consider the following best practices:

- Research Potential Buyers: Evaluate different buyers and their offers, ensuring they have a solid reputation and fair practices.

- Understand Market Value: Familiarise yourself with the current market value of your structured settlement to ensure the offer reflects a fair price.

- Be Prepared to Walk Away: Maintain a firm stance during negotiations, being willing to decline offers that do not meet your financial needs.

“Success in negotiating structured settlement sales lies in being informed, prepared, and assertive.”

Alternatives to Selling Structured Settlements

For individuals holding structured settlements, the decision to sell may not always be the most beneficial route. Understanding the alternatives can significantly impact long-term financial stability and overall quality of life. This section delves into various options available to those looking to leverage their structured settlements without resorting to a sale.

In lieu of selling a structured settlement, individuals can explore a variety of alternatives that may provide immediate cash flow or financial relief while preserving the integrity of their settlement payments. Below are several potential options that can be considered.

Alternative Options Available

Several avenues exist for individuals seeking alternatives to selling their structured settlements. These options can provide necessary liquidity without the drawbacks of a sale. The following list highlights some of these alternatives:

- Loan Against Settlement: Individuals may approach lenders to obtain a loan secured by the future payments of their structured settlement. This allows access to funds while retaining ownership of the settlement.

- Payment Plans: Negotiating a payment plan with creditors or service providers can alleviate immediate financial burdens, allowing for more manageable monthly expenses without selling the settlement.

- Structured Settlement Annuity: Converting the structured settlement into a different annuity type can provide better terms or more flexible payment schedules, enhancing financial control.

- Budgeting and Financial Planning: Engaging with financial advisors to develop a comprehensive budget can help ensure that the individual lives within their means, utilising their structured settlement efficiently.

Financial Strategies to Consider

Instead of parting with future payments from a structured settlement, various financial strategies can be employed. These strategies focus on resource management and investment opportunities rather than liquidation.

- Investing Settlement Payments: Rather than consuming settlement payments, individuals can invest these funds in stocks, bonds, or mutual funds, potentially yielding higher returns over time.

- Emergency Funds: Establishing an emergency fund with a portion of the settlement can provide a financial cushion without the need for selling the structured settlement, ensuring liquidity in times of need.

- Debt Management: Prioritising the payment of high-interest debts using structured settlement funds can free up cash flow, reducing financial stress and increasing disposable income.

- Utilising Financial Advisors: Seeking professional advice can uncover personalised strategies to maximise the benefits of structured settlements while maintaining control over finances.

Evaluating the Best Option Based on Individual Circumstances

Selecting the most suitable alternative to selling structured settlements hinges on a variety of personal factors. Individuals should assess their financial situation, long-term goals, and immediate needs to determine the best course of action.

- Current Financial Needs: Evaluate immediate cash requirements and how they align with the timing and amount of structured settlement payments.

- Long-Term Financial Goals: Consider future financial objectives, including retirement plans and investments, that may be negatively impacted by selling.

- Risk Tolerance: Individuals should assess their comfort level with financial risk when considering investments or loans related to their settlement.

- Consultation with Professionals: Engaging with financial advisors or legal professionals can provide insights tailored to specific circumstances, ensuring informed decision-making.

For those in need of immediate liquidity, exploring structured settlement cash now options can be quite beneficial. This route allows individuals to convert their future payments into a lump sum, thus alleviating financial burdens swiftly. Furthermore, if you’re contemplating the idea of selling structured settlement payments, it’s crucial to weigh the pros and cons carefully to make an informed decision.

In the realm of financial solutions, selling structured settlement payments can often provide a much-needed cash influx. This choice is particularly appealing for those facing unexpected expenses or seeking immediate funds. Alongside this, one might also consider options for obtaining structured settlement cash now for a more direct approach in financial management, ensuring that your needs are met without delay.