Structured settlement quote serves as a vital instrument for individuals navigating the complex realm of compensation post-injury or legal settlement. This comprehensive overview delves into the intricacies of what constitutes a structured settlement quote, highlighting its components and the methodologies employed for its calculation. By unpacking these elements, one can better appreciate the implications of such quotes on future financial arrangements and peace of mind.

As we traverse through the details, it becomes evident that understanding how to obtain and evaluate these quotes is essential for making informed decisions. The process involves several steps, including the necessary documentation and a handy checklist to guide individuals. Furthermore, we will analyse the various factors that influence the value of these quotes, ensuring that readers are well-equipped to compare options effectively.

Understanding Structured Settlement Quotes

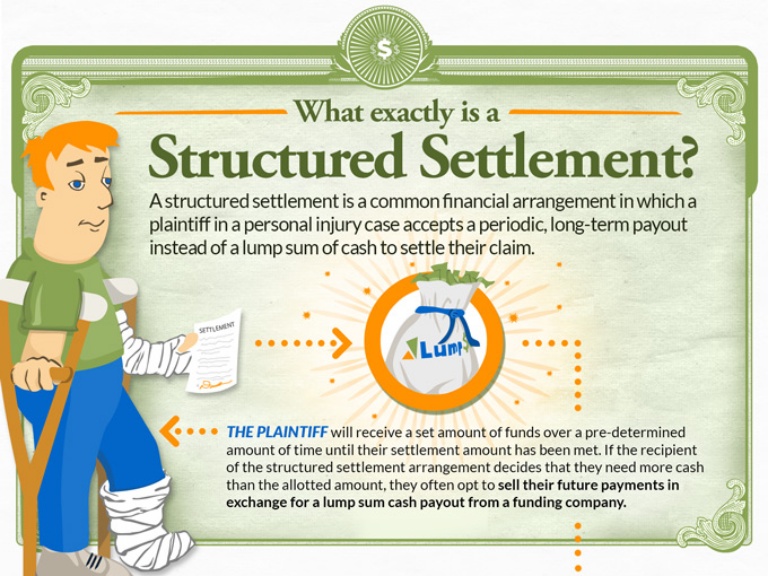

A structured settlement quote is a comprehensive financial proposal outlining the periodic payments that an individual will receive following a personal injury settlement or other lawsuit resolution. This mechanism serves to ensure that the claimant receives a steady income stream over time, rather than a lump sum payment, thereby enhancing financial security and management.

This quote consists of various components that contribute to understanding the total settlement value. It typically includes the total amount, the payment schedule, interest rates, and any provisions for adjustments over time. Each of these elements plays a pivotal role in calculating the finalized structured settlement.

Components of a Structured Settlement Quote

Understanding the components of a structured settlement quote is essential for grasping how these settlements are structured. The main components include:

- Total Settlement Amount: This is the overall value agreed upon in the settlement, which can encompass medical expenses, lost wages, and other damages.

- Payment Schedule: It details the frequency of the payments, whether they are monthly, quarterly, or annual, and specifies the length of the payment period.

- Interest Rates: Some structured settlements may accrue interest over time, which can affect the final payout and should be clearly stated in the quote.

- Future Provisions: This can include adjustments based on inflation or changes in financial circumstances, ensuring the payments retain their purchasing power.

Calculation of Structured Settlement Quotes

The calculation of structured settlement quotes involves several considerations, all aimed at ensuring that the awarded amount meets the claimant’s long-term financial needs.

An example of a structured settlement calculation could involve a claimant who receives a total settlement of £500,000. If the settlement is structured to provide £25,000 annually for 20 years, the total payout remains fixed at £500,000 without considering any interest. Alternatively, if the settlement is designed to provide £20,000 per year for the first 10 years and then £30,000 per year for the following 10 years, the structure may reflect different financial needs over time.

Another method of calculation might involve factoring in a discount rate to determine the present value of future payments. The formula for present value is given by:

Present Value = Future Payment / (1 + r)^n

where “r” represents the discount rate and “n” represents the number of years until the payment is received. This is crucial for understanding the time value of money when evaluating how much the structured settlement is worth in today’s terms.

In practical settings, structured settlement quotes are tailored to the specific circumstances of the case, often involving detailed negotiations between the parties involved. These factors ensure that the claimant is adequately compensated, while also aligning with their financial planning goals.

The Process of Obtaining a Structured Settlement Quote

Acquiring a structured settlement quote is a critical step for individuals looking to understand their financial options after receiving a settlement. This process involves meticulous planning and the gathering of necessary documentation to ensure that potential buyers can assess the value of the settlement accurately.

The process generally begins with identifying a reputable company that specializes in structured settlements. Once a company has been selected, the claimant must reach out to request a quote. This involves providing specific details about the settlement agreement and the anticipated needs for future payouts.

Steps Involved in Requesting a Structured Settlement Quote

The process of obtaining a structured settlement quote can be broken down into several key steps, each essential for facilitating a smooth transaction. Understanding these steps can empower claimants to approach their structured settlements with confidence.

- Research reputable companies that provide structured settlement quotes.

- Gather relevant information about your structured settlement. This includes details such as the amount of the settlement, payment schedule, and the insurance company involved.

- Complete a request form, either online or by contacting the company directly. Provide accurate information to ensure a precise quote.

- Submit necessary documentation that supports your request for a quote.

- Receive the quote and review it carefully, ensuring that it meets your financial expectations.

- Engage in discussions with the company to clarify terms and conditions of the offer.

- Decide whether to accept the quote, and if so, complete the necessary paperwork to initiate the transaction.

Documentation Needed to Obtain a Structured Settlement Quote

The documentation required to obtain a structured settlement quote is crucial, as it provides the necessary context and details for the assessment. Claimants should ensure they have the following documents ready:

- A copy of the original structured settlement agreement.

- Payment schedule outlining the frequency and amounts of future payments.

- Contact information for the insurance company managing the settlement.

- Identification documents, such as a government-issued ID, to verify identity.

- Any additional correspondence related to the settlement, such as court documents or letters from the insurance company.

Checklist for Individuals Seeking Structured Settlement Quotes

To streamline the process of obtaining a structured settlement quote, it is beneficial for claimants to utilise a comprehensive checklist. This ensures that all necessary steps are taken and that no critical details are overlooked.

“A well-prepared checklist can simplify the structured settlement quoting process, making it efficient and effective.”

- Identify potential companies for obtaining quotes.

- Compile all relevant documentation.

- Complete any required forms accurately.

- Review the payment terms of your settlement.

- Follow up with the chosen company after submission.

- Compare quotes from different companies for the best offer.

- Consult with a financial advisor if needed, to understand the implications of accepting a quote.

Factors Influencing Structured Settlement Quotes

The value of structured settlement quotes is contingent on a variety of factors, each contributing uniquely to the final amount. Understanding these variables is crucial for recipients hoping to maximise their financial outcomes. This section delves into the specific elements that can significantly affect the valuation of structured settlement offers.

Variables Impacting the Value of Structured Settlement Quotes

Several key variables play a critical role in determining the value of structured settlement quotes. These include:

- Type of Settlement: The nature of the settlement, whether it arises from a personal injury claim, wrongful death, or another type of litigation, influences the quote received. For instance, personal injury settlements often account for ongoing medical expenses, affecting the amount awarded.

- Payment Structure: The frequency and duration of payments, whether they are lump-sum or periodic payments, are crucial. A structured settlement designed for long-term benefits may yield a different quote than a one-time payment.

- Age of the Claimant: The age of the claimant at the time of the settlement can impact the financial calculations. Younger individuals may receive substantial future payment considerations, leading to higher quotes.

- Cost of Living Adjustments (COLA): Some structured settlements include provisions for adjustments based on inflation, which can significantly affect the overall value and thus the quoted amount.

Impact of Settlement Type on Quotes

The type of structured settlement plays a pivotal role in shaping the quote that a claimant might receive. Various types of settlements cater to different needs and circumstances, resulting in distinct financial implications.

- Personal Injury Settlements: Usually reflective of medical expenses and lost wages, these settlements often require careful actuarial assessments to determine future costs accurately.

- Workers’ Compensation Settlements: These settlements generally focus on lost earnings and rehabilitation costs and tend to vary depending on the nature of the injury and state laws.

- Wrongful Death Settlements: Typically addressing lost income and emotional suffering, these settlements can be quite substantial depending on the deceased’s earning potential and dependants’ needs.

The Role of Market Conditions

Market conditions can greatly influence structured settlement valuations. The financial environment in which the settlement is quoted determines the present value calculations and overall market viability.

- Interest Rates: Fluctuations in interest rates affect the discount rates applied to future payments. Lower interest rates usually result in higher structured settlement values, while higher rates lead to lower valuations.

- Economic Stability: Broader economic conditions can impact the financial stability of the companies involved in providing structured settlements, thus influencing the quotes offered.

- Investment Returns: Projected returns on investments play a role as well, with more optimistic forecasts leading to potentially higher settlement quotes, as the present value of future payments is calculated based on expected returns.

“Structured settlement quotes are deeply intertwined with both individual circumstances and broader market dynamics, making it essential to consider all influencing factors.”

Comparing Structured Settlement Quotes

When it comes to navigating the landscape of structured settlement quotes, a critical step is the comparison of offers from various providers. This process can help ensure that you make an informed decision that aligns with your long-term financial goals. By understanding how to effectively compare quotes, you can discern which option truly meets your needs.

Assessing the long-term benefits of different structured settlement quotes involves a meticulous examination of several factors. These factors include the payment amounts, the frequency of payments, and the terms associated with each quote. The following methods can assist in making these comparisons more structured and effective.

Methods for Comparing Quotes

To facilitate a thorough comparison of structured settlement quotes, several methods can be employed:

1. Create a Comparison Table: Organising quotes in a tabular format allows for a side-by-side examination. This can highlight the differences and similarities in key areas such as payment structure, total payout, and fees associated with the settlement.

2. Calculate the Present Value: Understanding the present value of future payments is essential. This calculation allows you to evaluate the worth of each quote in today’s terms, providing a clearer picture of potential long-term benefits.

3. Review Payment Schedules: Each quote may offer varying payment schedules. Assessing how these schedules align with your financial needs and obligations is crucial. A table can be particularly useful in this regard.

4. Consider Provider Reliability: Research the reputation and reliability of each provider. This includes reviewing customer testimonials, industry ratings, and the financial stability of the companies offering the quotes.

5. Engage a Financial Advisor: Consulting with a financial advisor can provide expert insights. They can help you interpret the quotes, assess the long-term financial implications, and guide you through the decision-making process.

Assessing Long-term Benefits

When evaluating the long-term advantages of structured settlement quotes, consider the following key aspects:

– Inflation Impact: Assess how inflation may affect the purchasing power of your payments over time. A fixed payment may become less valuable as the cost of living increases.

– Investment Opportunities: Explore how the payout structure aligns with potential investment opportunities. For instance, a larger upfront payment may allow for investment in assets that could yield higher returns compared to smaller, periodic payments.

– Tax Implications: While structured settlements typically have tax advantages, understanding how different quotes may impact your overall tax situation in the long term is vital.

Comparison Table Example

An effective way to visually compare structured settlement quotes is through a comparison table. Below is a sample layout that can be tailored to your specific quotes:

| Provider | Payment Amount | Payment Frequency | Total Payout | Fees | Present Value |

|---|---|---|---|---|---|

| Provider A | £500 | Monthly | £180,000 | £10,000 | £150,000 |

| Provider B | £600 | Quarterly | £200,000 | £15,000 | £160,000 |

| Provider C | £550 | Annually | £210,000 | £12,000 | £155,000 |

This table enables you to easily identify which provider offers the most advantageous terms relative to your financial requirements and future aspirations. By utilising such a systematic approach, you can enhance your decision-making process while engaging with structured settlement quotes.

If you’re considering ways to manage your financial future, one option is to sell structured settlement payments. This can provide immediate cash flow, which may be beneficial for various expenses. Alternatively, if you already have a structured settlement, you might explore the possibility to cash in structured settlements , allowing you to leverage your assets for current needs.

Thinking about the benefits of your structured settlement? You might want to explore options to cash in structured settlements to gain liquidity when needed. This can be particularly useful if unexpected expenses arise. Additionally, if you’re looking for a more permanent solution, you may wish to sell structured settlement payments , turning your future payouts into immediate cash.