Structured settlement money serves as a financial lifeline for individuals who have reached legal settlements, transforming what could be a considerable sum into a series of manageable payments over time.

This approach not only offers a sense of security but also facilitates better financial planning for those who may not be accustomed to handling large sums of money at once. The choice of structured settlements over lump-sum payments can significantly influence an individual’s financial trajectory, and understanding the intricacies of this process is essential for making informed decisions.

Understanding Structured Settlements

Structured settlements represent a unique financial arrangement wherein an individual receives compensation in the form of periodic payments rather than a singular lump sum. Typically arising from personal injury claims or other legal settlements, these arrangements are designed to provide long-term financial security for recipients, especially in cases where immediate financial needs may not align with the total compensation awarded.

The essence of structured settlement money lies in its systematic disbursement. Instead of receiving a one-time payment, the injured party receives a series of payments over a predetermined period. This can be tailored to suit the individual’s specific needs, such as monthly, annual, or even milestone payments. The structured settlement is often funded through an annuity purchased by the defendant’s insurance company, ensuring that the claimant has a reliable source of income throughout the agreed period.

Benefits of Choosing a Structured Settlement

Opting for a structured settlement offers several distinct advantages compared to a lump sum payment. The following points illustrate why many recipients find structured settlements to be a favourable choice:

- Financial Security: Periodic payments can ensure that the recipient’s financial needs are met over time, reducing the risk of mismanagement associated with a large lump sum.

- Tax Benefits: Structured settlement payments are generally tax-free, offering a financial advantage that lump sum payments do not provide.

- Budgeting Ease: Receiving payments at regular intervals aids in budgeting and managing expenses, particularly for individuals who may not have prior experience in handling large sums of money.

- Protection Against Inflation: Some structured settlements can include provisions for cost-of-living adjustments, helping to mitigate the impact of inflation on purchasing power.

Comparison with Other Forms of Compensation

When evaluating structured settlements against other compensation forms such as lump sum payments or traditional investments, key differences become apparent. Each option has its merits, but understanding these can guide beneficiaries in making informed decisions.

Structured settlements stand apart primarily in their payment structure and purpose. Unlike a lump sum payment, which can lead to swift depletion of funds if not managed wisely, structured settlements provide a predictable income stream over time. This ensures that recipients can meet long-term expenses such as medical costs, living expenses, and future financial obligations.

In contrast to investments, which carry inherent risks and require financial acumen, structured settlements offer a guaranteed return in the form of fixed payments. The predictability of a structured settlement can provide peace of mind, particularly for individuals who may not have the time or skill to manage volatile investment markets.

| Characteristic | Structured Settlements | Lump Sum Payments | Investments |

|---|---|---|---|

| Payment Schedule | Periodic | Single Payment | Variable |

| Risk Level | Low | Moderate to High | High |

| Tax Implications | Tax-free | Potentially Taxable | Varies |

| Financial Management | Easier | Requires Skill | Requires Active Management |

In summary, understanding the intricacies of structured settlements highlights their potential to provide long-term financial stability, whilst navigating the complexities of compensation options available to individuals post-settlement.

The Process of Receiving Structured Settlement Money

Receiving structured settlement payments is a crucial aspect for individuals who have been awarded compensation through legal settlements, particularly in personal injury cases. The structured settlement approach offers a steady stream of income, designed to meet the long-term financial needs of the claimant. Understanding the steps involved in receiving these payments, as well as the role of insurance companies and the associated timelines, is essential for effectively managing this financial resource.

The process of receiving structured settlement payments typically begins after a settlement agreement is reached. At this stage, the claimant and the liable party agree upon a sum of money that will be paid over time, rather than in a single lump sum. This arrangement is often designed to cater to specific needs, such as medical expenses or lost wages. The role of insurance companies is pivotal in managing these structured settlements; they facilitate the payment process and ensure that the funds are available to the claimant according to the established schedule.

Steps Involved in Receiving Payments

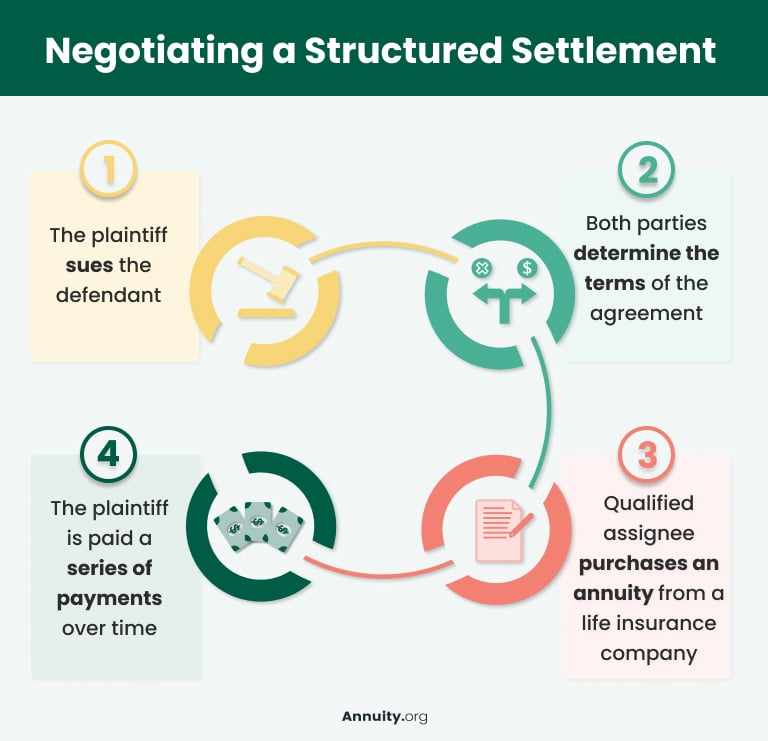

The steps involved in receiving structured settlement payments can be broken down into several key phases:

1. Settlement Agreement Finalisation: The claimant and the defendant reach an agreement on the total compensation amount, including the terms of payment.

2. Purchase of Annuity: The insurance company purchases an annuity from a financial institution, which is responsible for making the scheduled payments to the claimant.

3. Payment Schedule Establishment: A payment schedule is established, outlining the frequency (monthly, quarterly, annually) and amount of each payment.

4. Commencement of Payments: Payments begin on the agreed date, and the claimant receives their structured settlement funds as per the payment schedule.

Role of Insurance Companies

Insurance companies play a fundamental role in the management of structured settlements. They act as intermediaries between the claimant and the annuity provider, ensuring that the terms of the settlement are adhered to and that the necessary funds are disbursed accordingly. Their responsibilities include:

– Administration of Payments: Managing the payment process and ensuring timely disbursement to the claimant.

– Annuity Purchasing: Selecting a suitable annuity provider that will offer the best terms for the structured settlement.

– Compliance with Regulations: Ensuring that all financial transactions comply with relevant laws and regulations governing structured settlements.

These companies are crucial in maintaining the integrity and reliability of the structured settlement process, safeguarding the claimant’s financial future.

Timelines and Factors Affecting Payment Schedules

The timelines for receiving structured settlement payments can vary substantially based on several factors. Key considerations include:

– Settlement Agreement Terms: The specifics Artikeld in the settlement agreement dictate when payments commence and their frequency.

– Annuity Issuer Processing Times: The time it takes for the annuity provider to issue payments can impact the overall timeline.

– Claimant’s Life Circumstance: Changes in the claimant’s financial situation or needs may affect how and when payments are allocated.

For example, a claimant may receive an initial lump-sum payment followed by smaller periodic payments, which may be influenced by their immediate financial requirements. Understanding these factors is paramount for claimants to effectively plan their financial future.

“Structured settlements provide financial stability, ensuring that claimants receive their compensation in a manner that meets their long-term needs.”

Selling Structured Settlement Payments

Individuals may find themselves in circumstances where selling their structured settlement payments becomes a viable option. This decision is often influenced by personal financial needs or life changes that necessitate immediate liquidity. Whether it’s for significant medical expenses, educational costs, or to consolidate debt, the allure of receiving a lump sum payment can be tempting.

The selling process involves several legal and procedural steps designed to protect both the seller and the buyer. Understanding these steps is crucial for ensuring a smooth transaction and safeguarding one’s interests.

Reasons for Selling Structured Settlement Payments

Various factors can compel individuals to consider selling their structured settlement payments. Understanding these reasons provides insight into the motivations behind such decisions. Some common reasons include:

- Immediate financial needs for emergencies or unexpected expenses.

- Desire for a larger lump sum to invest in opportunities like business ventures or property.

- Consolidation of debt to manage financial obligations more effectively.

- Medical expenses that require urgent payment not covered by insurance.

- Educational costs for personal development or children’s schooling.

Step-by-Step Guide to Selling Structured Settlement Payments

Navigating the process of selling structured settlement payments involves a series of well-defined steps. Following this guide can help facilitate a smoother transaction.

1. Evaluate Your Needs: Assess your current financial situation and determine if selling is the best option.

2. Consult a Financial Advisor: Seeking advice from a professional can provide clarity on the implications of selling your payments.

3. Research Buyers: Investigate companies that specialise in purchasing structured settlements, ensuring they are reputable and transparent.

4. Request Quotes: Contact potential buyers to obtain quotes based on your specific situation and structured settlement terms.

5. Review Offers: Carefully analyse the offers received, paying attention to the fees and the total amount you will receive.

6. Legal Approval: Upon selecting a buyer, the sale must be approved by a court to ensure it adheres to legal standards and safeguards your rights.

7. Complete the Sale: Once approved, final documentation will be signed, and you will receive the agreed amount.

Pros and Cons of Selling Structured Settlements, Structured settlement money

It is essential to weigh the benefits and drawbacks of selling structured settlement payments versus retaining them. This comparison allows for informed decision-making and underscores the importance of considering long-term impacts.

Pros of Selling:

- Immediate access to cash for urgent needs.

- Ability to eliminate high-interest debt quickly.

- Potential for investment in high-return opportunities.

Cons of Selling:

- Reduced total payout compared to the long-term value of structured settlements.

- Possible fees and charges that diminish the lump sum received.

- Loss of guaranteed income stream for future financial security.

“The decision to sell should be meticulously considered, as it can significantly impact your financial future.”

Legal and Financial Considerations

Structured settlements are not merely financial tools; they are governed by a myriad of legal regulations that dictate their creation, modification, and transfer. Understanding these legal frameworks is essential for any individual contemplating the sale or management of structured settlement payments. This discussion will delve into the critical legal and financial considerations that surround structured settlements, including the laws governing their sale, tax implications, and prudent steps in selecting a reliable company for transactions.

Legal Regulations Surrounding Structured Settlements

The establishment and sale of structured settlements are regulated by both federal and state laws to protect the interests of recipients. A structured settlement is typically created as part of a personal injury claim, whereby the recipient agrees to receive periodic payments over time, rather than a lump sum. The legal protection for these arrangements is primarily found in the Structured Settlement Protection Act (SSPA) and corresponding state statutes.

The SSPA aims to ensure fair practices in the sale of structured settlement payments. It mandates that any transfer of payments must be court-approved, requiring the seller to demonstrate that the transaction is in their best interest. Additionally, state laws may impose additional requirements, including disclosures about the financial implications of the sale and mandatory waiting periods.

“Structured settlements are designed to provide long-term financial security for claimants, hence the stringent regulations surrounding their sale.”

Tax Implications of Receiving Structured Settlement Payments

When it comes to structured settlements, tax implications are crucial. Generally, the payments received from a structured settlement are tax-free, as they are considered compensation for personal injury or sickness. This tax exemption helps maintain the financial viability of the recipient, allowing them to utilise funds without the added burden of tax liabilities.

However, it’s important to note that if a recipient decides to sell their structured settlement payments, the proceeds may be subjected to different tax rules. The tax treatment of sale proceeds can vary based on several factors, including the nature of the settlement and state tax regulations. Therefore, it is wise for recipients to consult with a tax professional to assess potential tax liabilities before finalising any transaction.

Selecting a Trustworthy Company for Structured Settlement Transactions

Choosing the right company to facilitate the sale or management of structured settlement payments is pivotal. The integrity and reliability of the company can significantly affect the outcome of the transaction. When evaluating potential buyers or administrators, several factors should be considered to ensure a secure and beneficial partnership.

It is advisable to seek companies with a proven track record in the industry. Reputable companies should be able to provide verifiable references and testimonials from previous clients. Moreover, prospective sellers should ensure that the company is transparent about fees and the terms of the transaction. Reading online reviews and checking for any complaints with regulatory bodies can also provide insight into the company’s reliability.

A key tip is to engage with companies that offer free consultations, allowing potential sellers to gauge the professionalism and knowledge of the staff before committing. This initial interaction can be crucial in determining whether a company prioritises the seller’s best interests.

“Due diligence is essential when selecting a company for structured settlement transactions; a trustworthy partner can make all the difference.”