selling structured settlements sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. A structured settlement serves as a financial arrangement typically established following a legal settlement, providing a steady stream of payments over time rather than a single lump-sum payout. Understanding the nuances between these two forms of compensation is essential, as is appreciating the historical context that led to the inception of structured settlements, which were devised to offer long-term financial security to recipients.

As we delve deeper into the intricacies of the selling process, one must consider the necessary steps, legal requirements, and documentation that accompany such a transaction. It’s also prudent to evaluate offers meticulously, taking into account various factors that can influence the value of a structured settlement, alongside a comparative analysis of companies that purchase these financial assets. With potential risks and benefits at play, including real-world case studies, this exploration aims to equip individuals with the knowledge they need to navigate the world of selling structured settlements effectively.

Understanding Structured Settlements

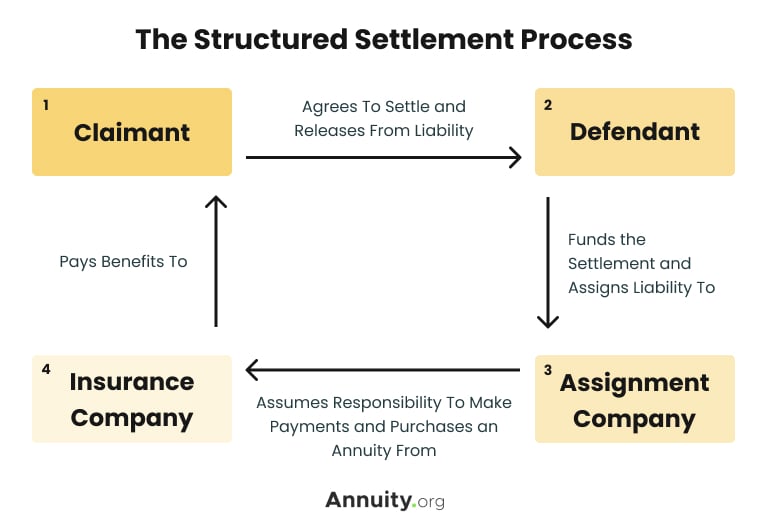

Structured settlements represent a financial arrangement in which an individual receives compensation through a series of periodic payments, often following a legal settlement or personal injury claim. The primary aim of structured settlements is to provide the recipient with a stable financial future, ensuring they have a reliable income stream for medical expenses, living costs, or any other financial obligations that may arise over time.

Structured settlements diverge significantly from lump-sum payments, where the recipient receives the entire settlement amount in one go. While lump-sum payments offer immediate access to funds, they come with the risk of mismanagement or overspending. In contrast, structured settlements are designed to mitigate such risks by distributing payments over a predetermined period, which can enhance financial security and allow for long-term planning.

Historical Overview of Structured Settlements, Selling structured settlements

The concept of structured settlements emerged in the 1970s as a means to ensure that injury victims received the financial support they required over an extended period, rather than a singular payout that could be quickly depleted. Initially, the practice gained traction in the United States following the enactment of the Periodic Payment Settlement Act of 1982. This legislation was aimed at encouraging the use of structured settlements in tort cases, particularly in personal injury claims.

The popularity of structured settlements has since expanded globally, with jurisdictions recognising their benefits in safeguarding the financial well-being of claimants. This transition marked a significant shift in how compensation was approached, placing the emphasis on long-term care rather than short-term financial relief. An important motivation driving this change was the acknowledgment that individuals, particularly those with serious injuries requiring ongoing treatment, would benefit more from a consistent income over time.

One notable case that exemplifies the effectiveness of structured settlements involved a settlement for a young man who suffered a severe injury in a car accident. Instead of receiving a lump sum, he was awarded a structured settlement that provided him with monthly payments for life. This arrangement not only secured his financial future but also ensured that he could manage his ongoing medical expenses without the fear of depleting his funds.

Overall, structured settlements represent a pivotal development in the realm of financial compensation, offering a sustainable model that prioritises the long-term needs of recipients.

The Selling Process of Structured Settlements: Selling Structured Settlements

The selling process of structured settlements is a critical area for individuals seeking immediate liquidity from future payments. This overview will elucidate the fundamental steps, legal requirements, and necessary documentation involved in the transaction. Understanding each phase is essential for ensuring a smooth and legally compliant sale.

Steps Involved in Selling a Structured Settlement

The process of selling a structured settlement involves several key steps that must be meticulously followed to facilitate a successful transaction. Each step plays a vital role in ensuring that both the seller and the purchaser are adequately protected and informed.

1. Initial Assessment: The seller evaluates their structured settlement to determine the total value of future payments and their immediate financial needs.

2. Research Potential Buyers: It is essential to identify reputable companies or investors interested in purchasing structured settlements. Researching their credibility and customer reviews can prevent potential scams.

3. Request Quotes: Sellers should request quotes from multiple buyers to compare the offers and terms. This helps in making an informed decision.

4. Select a Buyer: After careful consideration, the seller chooses the most favourable offer based on terms and financial implications.

5. Legal Document Preparation: The seller must gather all necessary legal documentation, including the original settlement agreement and identification.

6. Court Approval: In most jurisdictions, a court must approve the sale to ensure that it serves the best interests of the seller, particularly if a minor is involved.

7. Finalisation of Sale: After obtaining court approval, the seller finalises the sale, transferring the rights of future payments to the buyer in exchange for a lump sum.

Legal Requirements and Documentation

Understanding the legal requirements and documentation necessary to sell a structured settlement is imperative. The process encompasses various legalities that ensure the transaction adheres to relevant laws and regulations.

– Court Approval: Most jurisdictions mandate that the transfer of structured settlement payments requires court approval. This is to safeguard the seller’s interests and ensure that they are making an informed decision.

– Documentation Required: The following documents are essential for a successful sale:

– The original structured settlement agreement.

– Proof of identity, such as a government-issued ID.

– Any amendments to the original settlement.

– Tax documents related to the structured settlement.

– A disclosure statement detailing the terms of the sale, including any fees or costs involved.

The importance of these documents cannot be overstated, as they ensure that the seller’s rights are protected and that the transaction abides by statutory requirements.

It is critical to consult with a legal professional when navigating the selling process to ensure compliance and protection throughout the transaction.

The structured settlement selling process is intricate, requiring careful navigation through each step and adherence to legal mandates. By understanding these elements, sellers can make informed decisions and achieve their financial goals effectively.

Evaluating Offers for Structured Settlements

The process of evaluating offers for structured settlements is crucial in ensuring that you receive the most advantageous financial outcome. With a myriad of companies vying for your business, understanding the factors influencing the value of their offers, as well as the distinctions between them, can significantly impact your decision-making.

When considering offers for structured settlements, several key factors come into play that ultimately shape the value of the offers presented. These include the present value of the future cash flows, interest rates, market conditions, and the financial stability of the purchasing company.

Factors Influencing Value of Offers

To make an informed decision, it is essential to recognise the various factors that can affect the valuation of structured settlement offers. These factors encompass a range of financial and market elements that can have a significant impact on the final offer you receive.

- Present Value Calculations: The future payments of a structured settlement are typically discounted to determine their present value, which relies heavily on prevailing interest rates.

- Life Expectancy: An assessment of the recipient’s life expectancy can influence the valuation; longer life expectancy may result in lower offers.

- Company Reputation: The credibility and financial health of the purchasing company can affect the offer. Established companies may provide better terms.

- Market Conditions: Economic factors and interest rate trends significantly impact the value of structured settlements in the financial market.

Comparing Companies Purchasing Structured Settlements

The landscape of companies that purchase structured settlements is diverse, and comparing their offers is vital. Different companies have varying policies, fee structures, and methods of calculating present values.

To assist in comparing offers, consider the following aspects:

- Fee Structures: Some companies charge a flat fee, while others may have a percentage-based fee. Understanding these can help in evaluating net proceeds.

- Speed of Transaction: Different companies may vary in their processing times. Some might offer expedited services for urgent needs.

- Customer Service: Reviews and testimonials can provide insight into a company’s customer service quality, which is crucial for a smooth process.

- Flexibility of Offers: Some companies may offer more flexible terms or better negotiation options than others.

Checklist for Evaluating Offers

Having a structured checklist can greatly aid in assessing offers before making a final decision, allowing you to weigh all critical aspects methodically. Below are essential criteria to consider:

- Understand the Total Amount: Ensure you are clear about the total value of the offer and how it compares to the total value of your original structured settlement.

- Review the Terms: Scrutinise the terms of the offer for any hidden fees or conditions that may alter the net value.

- Request Multiple Quotes: Gathering several offers allows for better comparisons and negotiation leverage.

- Research Company Background: Investigate the purchasing company’s reputation, including ratings from agencies such as the Better Business Bureau.

- Consult a Financial Advisor: Seeking professional advice can provide clarity, especially concerning tax implications and long-term financial impacts.

“Always ensure you have a comprehensive understanding of the full implications of any structured settlement offer before proceeding.”

Potential Risks and Benefits of Selling

Selling a structured settlement can seem like a tempting option for individuals looking for immediate cash flow. However, it is essential to consider both the potential financial risks and benefits that may accompany such a decision. Understanding these aspects will help individuals make informed choices about their financial futures.

The financial risks of selling a structured settlement primarily revolve around the loss of guaranteed future income and the potential for receiving less than the total net worth of the settlement. While the immediate cash may provide relief in the short term, there are long-lasting implications that must be weighed carefully.

Financial Risks of Selling a Structured Settlement

The following points Artikel the various financial risks associated with selling a structured settlement. A thorough evaluation can ensure that individuals are prepared for the consequences of their decision:

- Loss of Fixed Income: By selling, individuals forfeit the guaranteed regular payments that provide financial stability over time.

- Reduced Overall Value: The upfront cash received is often less than the future value of the settlement, resulting in a financial loss in the long run.

- Fees and Legal Costs: The selling process can incur legal and administrative fees that diminish the cash received from the sale.

- Tax Implications: Depending on the circumstances, selling a structured settlement may lead to tax liabilities that can further reduce the net benefit.

Benefits of Selling a Structured Settlement

Despite the risks, there are notable benefits that can make selling a structured settlement appealing. The following items highlight the potential advantages of this decision:

- Immediate Cash Availability: Selling a structured settlement provides immediate liquidity, allowing individuals to address urgent financial needs or investments.

- Debt Repayment: The cash obtained can be utilised to pay off high-interest debts, providing financial relief and potentially improving credit scores.

- Investment Opportunities: Individuals may use the proceeds from the sale to invest in ventures that could yield greater returns than the structured settlement payments.

- Flexibility in Financial Planning: A lump sum allows for more versatile financial planning and the ability to address personal goals more effectively.

Case Studies of Individuals Who Sold Their Structured Settlements

Examining real-life examples can illuminate the diverse outcomes of selling structured settlements. Here are two case studies that underscore varying results from such decisions:

Case Study 1: Sarah, a 35-year-old woman involved in a car accident, opted to sell her structured settlement for £50,000 to cover unexpected medical expenses. The immediate cash alleviated her financial stress, yet she later recognised that she forfeited over £100,000 in future payments, leading to regret during her retirement years.

Case Study 2: John, a 50-year-old man, sold his structured settlement for £70,000 to invest in a promising start-up. The venture succeeded, eventually yielding a return of £200,000 within five years. In John’s case, the sale of his structured settlement led to significant financial gain rather than loss, showcasing the potential benefits of strategic financial decisions.

Overall, while selling a structured settlement can provide immediate financial relief, it is crucial to understand the long-term consequences and evaluate the decision carefully to safeguard future financial well-being.

When considering the options available for those with ongoing payments, one might be intrigued by the notion to cash in structured settlements. This process allows individuals to receive a lump sum rather than waiting for periodic payments, which can be particularly advantageous in times of financial need. Furthermore, understanding the nuances of structured settlement money can aid in making informed decisions regarding financial planning and investment.

Individuals contemplating their financial future often find themselves exploring the benefits of structured settlement money. This form of compensation provides a steady income stream, yet there are scenarios where one may wish to cash in structured settlements for immediate access to funds. Such decisions should be made with careful consideration of both short-term needs and long-term financial health.