Selling my structured settlement takes centre stage as we delve into the intricate world of financial arrangements that often leave recipients pondering their options. Structured settlements, a means to provide long-term income following personal injury or legal settlements, present both benefits and challenges. Understanding these factors is crucial for anyone considering selling their structured settlement to access immediate cash.

This exploration will guide you through the essential elements of structured settlements, detailing their advantages and drawbacks, the selling process, and the financial implications involved. In addition, we shall examine alternatives to selling, ensuring you are well-informed to make the best decision for your financial future.

Understanding Structured Settlements

Structured settlements represent a financial arrangement in which a claimant receives compensation through periodic payments instead of a lump sum. This method is often employed in cases involving personal injury claims, wrongful death, or other legal settlements where the injured party is compensated for their losses over time. The intention behind structured settlements is to provide the recipient with a reliable income stream, which can be particularly beneficial for long-term needs.

The advantages of structured settlements are numerous. Firstly, they offer financial security by ensuring that the individual receives consistent payments over a specified duration, which can be crucial for managing ongoing medical expenses or living costs. Additionally, structured settlements can be tailored to the recipient’s needs, allowing for flexible payment schedules or amounts. However, there are notable disadvantages. The most significant is the potential lack of access to immediate funds, which can be problematic in emergencies where a lump sum would be more advantageous. Furthermore, the terms of structured settlements can be complex, and recipients often lack control over their investment decisions regarding the funds.

Common Scenarios for Structured Settlements, Selling my structured settlement

Structured settlements are frequently awarded in various contexts, particularly those involving significant personal injury cases. The following scenarios illustrate common instances when structured settlements may be granted:

- Personal Injury Claims: Individuals who suffer injuries due to accidents may receive structured settlements as part of their compensation for medical expenses, lost wages, and pain and suffering.

- Medical Malpractice: Victims of medical negligence often receive structured settlements to cover long-term medical treatment and rehabilitation costs.

- Wrongful Death Cases: In instances where a person has died due to negligence, structured settlements may be awarded to provide financial support to surviving family members over time.

- Disability Cases: Individuals who have become disabled as a result of an accident or illness may receive structured settlements to ensure their financial stability for the duration of their disability.

The structured settlement process often involves negotiations between the injured party, their legal representatives, and the insurance company. Once an agreement is reached, the settlement amount is typically funded by an annuity, which is purchased by the defendant’s insurance company. This ensures that the payments are made reliably over the agreed-upon time frame.

The nature of structured settlements ensures that funds are not squandered, providing a safeguard for recipients who may lack financial literacy or experience in managing large sums of money.

In summary, structured settlements serve as a financial tool designed to meet the long-term needs of individuals who have been awarded damages due to various unfortunate circumstances. By understanding both the advantages and drawbacks, recipients can make informed choices regarding their financial futures.

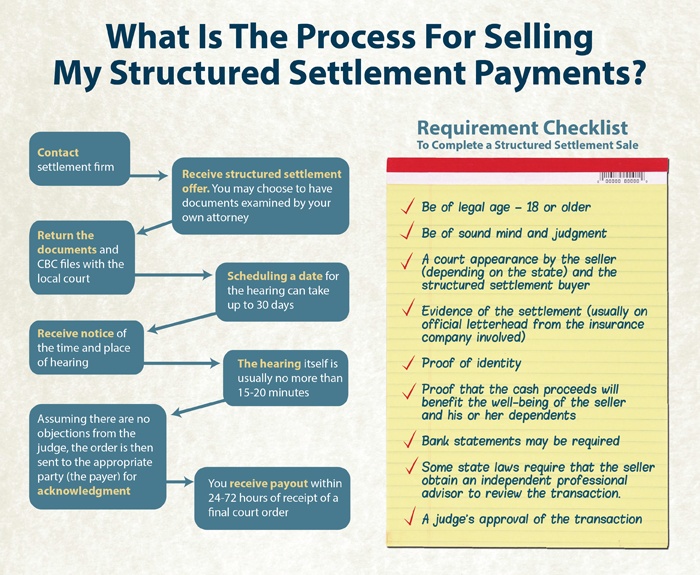

The Process of Selling a Structured Settlement: Selling My Structured Settlement

Selling a structured settlement can be a complex endeavour, often requiring careful consideration of various legal and practical factors. Those looking to liquidate their future payments for a lump sum must navigate a defined process that ensures compliance with relevant regulations. Understanding these steps and what they entail is crucial for a successful transaction.

Legal requirements form a significant part of the structured settlement selling process. It is essential to adhere to specific statutes and regulations that govern such sales, primarily to protect consumers from potential exploitation. Sellers must be aware of the following requirements:

Steps Involved in Selling a Structured Settlement

Navigating the process of selling a structured settlement typically involves several key steps. These steps ensure that the seller is well-informed and compliant with legal standards. The major steps include:

- Assessment of the Structured Settlement: Before taking any action, sellers should evaluate the total value of their structured settlement, including payment amounts and schedules.

- Researching Potential Buyers: It is imperative to identify reputable companies or financial institutions that specialise in purchasing structured settlements.

- Consulting Legal Experts: Engaging a legal professional to understand the intricacies of the sale and to ensure compliance with state laws is advisable.

- Submitting an Application: Sellers must complete and submit an application to the chosen buyer, detailing the terms of the settlement and the payments to be sold.

- Reviewing the Offer: After receiving an offer, sellers should carefully review the terms, including the lump sum amount being offered in exchange for future payments.

- Legal Approval: Most jurisdictions require court approval for the sale. This step ensures that the transaction is fair and in the seller’s best interest.

- Finalising the Sale: Once court approval is obtained, the final paperwork is executed, and the seller receives the agreed-upon lump sum payment.

Legal Framework Governing the Sale

The legal landscape surrounding structured settlements is quite intricate. The following points Artikel the core legal requirements that must be adhered to when selling a structured settlement:

- State Laws and Regulations: Different states have varying laws that govern the sale of structured settlements. It is crucial to consult the specific regulations applicable to the seller’s location.

- Disclosure Requirements: Sellers must receive clear and comprehensive information about the proposed sale, including potential risks and benefits.

- Court Approval: Most jurisdictions mandate that a court must review and approve the sale to ensure that it is in the seller’s best interests and that they fully understand the implications.

- Waiting Periods: Some states impose mandatory waiting periods before the sale can be finalised, allowing sellers time to reconsider their decision.

Identifying Potential Buyers

Identifying the right buyer is a critical step in selling a structured settlement. Potential buyers typically include specialised financial firms and companies that focus on purchasing structured settlements. The following methods can facilitate the approach to these buyers:

- Researching Reputable Companies: Conduct thorough research to find companies with a solid reputation and proven track record in structured settlement purchases.

- Seeking Referrals: Engaging with financial advisors or legal professionals can provide leads on trustworthy buyers who can facilitate the selling process.

- Comparing Offers: Gathering multiple offers allows sellers to compare terms and choose the best financial deal that suits their needs.

- Direct Communication: Contacting potential buyers directly to discuss their purchase processes can help sellers understand their options and gauge responsiveness.

Financial Implications of Selling

Selling a structured settlement can have significant financial implications, particularly concerning long-term income. The decision to sell stems from the need for immediate liquidity, yet it is vital to weigh this against the potential loss of future financial security. Understanding the financial impact of such a decision is crucial for making an informed choice.

The financial impact of selling a structured settlement often manifests in both immediate and future cash flow considerations. When one opts to sell a settlement, the immediate cash received is typically less than the total future payments that would have been received over time. This differential can have long-lasting effects on an individual’s financial landscape, as future payments are often structured to provide a steady income over a set period. Therefore, this trade-off between immediate cash and future income warrants careful examination.

Comparison of Upfront Cash Versus Future Payments

When weighing the decision to sell a structured settlement, it is important to delineate the differences between the upfront cash received and the future payments that would have otherwise been collected. The immediate cash offer is generally enticing; however, the long-term financial consequences can be substantial.

The following points illustrate the key differences:

- The upfront cash amount is typically a discounted value of the total future payments, meaning sellers might receive significantly less than the total value of their settlement.

- Future payments provide a guarantee of income over time, which can be particularly valuable for budgeting and planning expenses, especially for long-term financial goals such as retirement or education.

- It is essential to consider inflation; future payments may lose purchasing power over time, while upfront cash can be invested for potential growth.

Fees and Costs Associated with Selling

Engaging in the sale of a structured settlement involves several fees and costs that can impact the net proceeds one ultimately receives. These expenses can vary depending on the company facilitating the sale and the complexity of the transaction.

Consider the following costs that may be involved:

- Brokerage fees are a common cost, often taking a percentage of the settlement value, which can reduce the overall cash received.

- Legal fees may arise if professional advice is sought, which can add to the total cost of the transaction.

- Court costs can occur if judicial approval is necessary for the sale, particularly in jurisdictions where selling structured settlements requires court oversight.

- Discount rates applied by the buying company can substantially affect the final offer, potentially leaving sellers with a smaller cash sum than anticipated.

“The decision to sell a structured settlement should always consider not just immediate financial needs but also the potential long-term impact on income and financial stability.”

Alternatives to Selling a Structured Settlement

When faced with the pressing need for cash, many individuals contemplate selling their structured settlements. However, there exist various alternatives that can provide liquidity without relinquishing future payments. Exploring these options can offer financial relief while retaining the benefits associated with structured settlements.

One should consider a range of financing options that allow access to cash quickly without the long-term implications of selling a structured settlement. Retaining the structured settlement can provide a reliable income stream, especially in the face of unforeseen financial challenges. Below are some financing alternatives to selling a structured settlement that may be worth considering.

Financing Options for Quick Cash Access

Various financing options can be explored that allow individuals to access cash swiftly while preserving their structured settlement. Each option has its own merits and potential drawbacks, making it essential to evaluate them thoroughly. The following list highlights some viable alternatives:

- Bank Loans: Traditional bank loans can provide immediate cash. However, they often require good credit and can involve lengthy approval processes.

- Personal Loans: Unsecured personal loans from financial institutions can be a quick way to access funds, though interest rates might be higher than secured options.

- Credit Cards: Using credit cards for cash advances can offer immediate liquidity, but the associated interest rates are typically steep.

- Pawn Loans: Pawning valuable assets can yield quick cash, albeit often at a lower value than the asset’s worth.

- Peer-to-Peer Lending: Online platforms enable individuals to borrow money from peers, often with competitive interest rates and flexible repayment terms.

- Home Equity Loans or Lines of Credit: If applicable, tapping into home equity can provide significant funds, though this option comes with risks associated with home ownership.

Retaining a structured settlement rather than liquidating it can often be beneficial. The long-term stability and guaranteed income provided by these settlements can outweigh the immediate financial relief gained from cashing out. Structured settlements are often designed to meet specific financial needs over time, ensuring that individuals have a reliable source of income for essential expenses.

“Retaining a structured settlement can safeguard against financial uncertainty, ensuring a steady income stream for years to come.”

When considering the advantages of a structured settlement cash option, one must appreciate the financial flexibility it can provide. This approach allows individuals to access funds more swiftly, which can be particularly beneficial in times of need. Furthermore, understanding how to acquire money for structured settlement can empower one to make informed decisions, ensuring they maximise their financial potential.

Navigating the complexities of a money for structured settlement situation can often feel daunting. However, by exploring options for structured settlement cash , individuals can significantly enhance their liquidity. This knowledge not only aids in immediate financial relief but also in planning for future investments, ultimately leading to a more secure financial standing.