Sell your structured settlement and unlock the potential of your financial future. Many individuals find themselves in situations where a steady stream of payments is less beneficial than a lump sum that can address immediate needs or desires. Understanding the ins and outs of structured settlements, including their purpose and the cases that typically lead to them, is crucial for making informed decisions.

Structured settlements serve as a means to provide financial stability over time, often arising from personal injury claims or other legal settlements. However, the allure of selling these settlements lies in the ability to access a larger sum of money now, rather than waiting for future payments. This overview will guide you through the reasons one might consider selling, the processes involved, and the implications of such a decision.

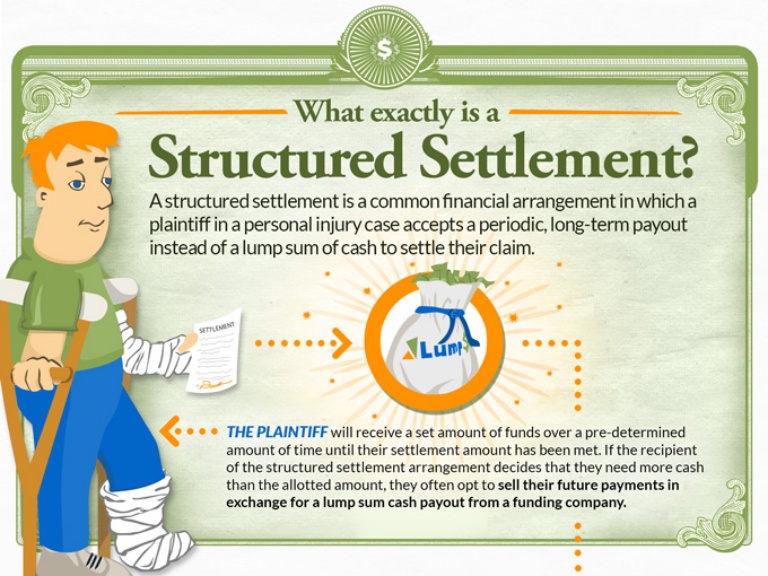

Understanding Structured Settlements

Structured settlements are financial arrangements designed to provide compensation to individuals over time, often following personal injury claims, wrongful death cases, or other legal matters. They serve the primary purpose of ensuring that the claimant receives their awarded sum in a series of payments rather than a single lump sum. This arrangement can be particularly beneficial in safeguarding the financial future of the recipient, allowing for stability and planned expenditures.

The fundamental distinction between lump-sum payments and structured settlements lies in the manner of disbursing funds. A lump-sum payment delivers the entire compensation amount at once, offering immediate access to funds. In contrast, structured settlements offer periodic payments, which may occur monthly, annually, or over a specified duration. This can mitigate the risk of frivolous spending and may yield tax advantages, as structured settlements are often exempt from federal and state income taxes.

Types of Cases Resulting in Structured Settlements, Sell your structured settlement

Certain legal scenarios frequently culminate in structured settlements, primarily to address the long-term needs of the injured parties. These cases typically encompass:

- Personal Injury Claims: Cases resulting from accidents, medical malpractice, or negligence where the plaintiff suffers significant injury often result in structured settlements to ensure ongoing care and rehabilitation costs are met.

- Workers’ Compensation: Employees injured on the job may receive structured settlements to cover medical expenses and lost wages, allowing for a steady income stream during recovery.

- Wrongful Death Claims: In instances where a death has occurred due to negligence, structured settlements can provide financial support to the deceased’s dependents, helping them manage future expenses.

- Product Liability Cases: Victims injured by defective products may be awarded structured settlements to ensure they have funds available for long-term medical care or lifestyle changes necessitated by their injuries.

The benefits of structured settlements are profound, as they not only consider the immediate financial needs of the claimant but also aim to provide lasting security. This arrangement can be particularly advantageous for recipients who may find it challenging to manage larger sums effectively.

Structured settlements are designed to provide a steady stream of income, safeguarding the financial future of claimants over time.

Reasons to Sell Your Structured Settlement

Individuals often find themselves at a crossroads when evaluating their financial situations, which may lead them to consider selling their structured settlements. Various personal circumstances can influence this decision, including unexpected financial burdens, changes in health, or the desire to capitalise on better investment opportunities. Structured settlements, while designed to provide long-term financial security, may not always align with an individual’s immediate or evolving needs.

Selling a structured settlement can offer significant financial advantages, particularly in times of urgent necessity. The lump sum received from the sale can be instrumental in addressing pressing expenses such as medical bills, home repairs, or even debt repayment. For some, this immediate influx of cash can also provide the chance to invest in lucrative opportunities that may otherwise be out of reach.

Circumstances Leading to the Sale of Structured Settlements

Many individuals find themselves in situations that prompt the consideration of selling their structured settlements. These scenarios often include:

- Medical Emergencies: Sudden health issues can lead to skyrocketing medical costs that require immediate funding. The sale of a structured settlement can alleviate this financial pressure.

- Debt Accumulation: Over time, individuals may accumulate debts that become unmanageable, and selling a structured settlement can provide the necessary funds to clear these obligations.

- Investment Opportunities: The desire to invest in a business venture or real estate may compel an individual to convert a portion of their structured settlement into an immediate cash influx.

- Life Changes: Significant life events such as divorce or job loss can drastically alter financial needs, making it essential to adapt by liquidating structured settlement payments.

Financial Advantages of Selling Structured Settlements

The decision to sell a structured settlement can be anchored in various financial benefits, which can significantly impact one’s financial landscape. Key advantages include:

- Immediate Access to Cash: Rather than waiting for future payments, selling allows for immediate liquidity, aiding in urgent financial situations.

- Elimination of Long-Term Debt: The lump sum can be used to pay off high-interest debts, thereby improving overall financial health.

- Investment in High-Yield Ventures: Individuals may choose to reinvest the lump sum into opportunities that offer higher returns compared to the guaranteed payments of a structured settlement.

- Enhanced Financial Freedom: Selling a structured settlement can provide flexibility, allowing individuals to make choices that better suit their current life circumstances.

Common Misconceptions About Selling Structured Settlements

A number of misconceptions surround the process of selling structured settlements, which can deter individuals from making informed decisions. It is essential to clarify these misunderstandings:

- Loss of Future Income: Many believe selling their structured settlement equates to forfeiting their future income entirely; however, options exist to sell partial payments while retaining some cash flow.

- Complicated Process: The belief that selling a structured settlement is overly complicated can prevent individuals from exploring this option, when in reality, it can be relatively straightforward with the right guidance.

- High Fees and Costs: While there are fees associated with selling structured settlements, many individuals find that the benefits far outweigh the costs in terms of financial relief and opportunity.

- Neglecting Financial Advice: Some may assume they do not need professional advice when selling their structured settlements, overlooking the value of consulting with financial advisors to optimise their decisions.

The Selling Process

When considering the sale of a structured settlement, it is essential to understand the process involved thoroughly. The selling process can be complex, requiring careful consideration of various steps, legal requirements, and the options available through third-party companies. Understanding these elements will empower you to make an informed decision regarding your financial future.

The selling process typically involves several key steps, each vital to ensuring a smooth transaction. Initially, it is crucial to assess your structured settlement and determine its total value. Following this, research potential buyers, which primarily include specialised companies that focus on purchasing structured settlements. Once you have identified an appropriate third-party company, you will need to submit an application, often accompanied by relevant documentation. After receiving an offer, you can negotiate the terms before finalising the sale and obtaining approval from a court, which may require a hearing.

Steps Involved in Selling a Structured Settlement

The steps to selling a structured settlement consist of the following crucial phases:

1. Assessment of Structured Settlement: Determine the total value of your settlement, including future payment amounts and schedules.

2. Research of Buyers: Identify reputable companies that specialise in purchasing structured settlements. Look for customer reviews and assess their offers.

3. Application Submission: Fill out an application form with the chosen buyer, providing comprehensive details about your structured settlement.

4. Documentation Preparation: Gather necessary documentation, including the original settlement agreement and payment history.

5. Review of Offer: Once you receive an offer, evaluate the terms and negotiate if needed to reach a satisfactory agreement.

6. Court Approval: The final step involves obtaining court approval for the sale to ensure that it is in your best interest, often necessitating a hearing.

Comparison of Options for Selling Structured Settlements

When considering selling your structured settlement, various options are available through third-party companies. Each option presents different benefits and drawbacks.

– Direct Sale to Companies: This involves selling your settlement directly to a financial company. It is often a straightforward process but may yield lower total amounts compared to other methods.

– Secondary Market Transactions: Some individuals choose to sell their settlements on a secondary market, potentially attracting higher offers from multiple buyers. However, this process can be time-consuming and requires careful navigation.

– Auction Platforms: Auctioning your structured settlement can lead to competitive bidding, which may maximise your sale price. Nonetheless, it entails additional fees and uncertainties regarding the final offer.

Legal Requirements and Documentation Necessary for Selling Structured Settlements

Selling a structured settlement is not solely a financial transaction but also a legal one, governed by specific regulations. The legal requirements typically include:

– Court Approval: Most jurisdictions require court approval to ensure that the sale serves the seller’s best interests. This judicial oversight helps protect vulnerable individuals from potentially harmful financial decisions.

– Documentation: Essential documents for the sale often comprise:

– The original structured settlement agreement detailing payment terms.

– Evidence of payment history and any prior transfers of the settlement.

– Identification documents verifying the seller’s identity.

In instances where a structured settlement was established as part of a personal injury claim, the seller might need to attest that no other claims are pending that could affect the settlement. It is advisable to consult a legal professional experienced in structured settlements to navigate the complexities of the process, ensuring compliance with all legal stipulations and optimisation of your financial outcome.

Evaluating Offers and Making Decisions: Sell Your Structured Settlement

When considering the sale of a structured settlement, it is imperative to meticulously evaluate the offers presented by potential buyers. This process not only involves assessing the financial aspects but also understanding the long-term implications of such a decision on your overall financial health.

To effectively assess offers, one must establish a robust method that encompasses several critical factors. By adhering to a systematic approach, individuals can ensure they make informed decisions that align with their financial goals and circumstances.

Checklist for Evaluating Offers

Before finalising any sale, it is essential to consider a comprehensive checklist that encompasses various factors influencing the transaction. Here are key elements to evaluate:

- Offer Amount: Examine the total amount being offered against the present value of your structured settlement. Ensure that it is a fair reflection of your asset’s worth.

- Discount Rate: Assess the discount rate applied to your structured settlement. A higher discount rate may result in a lower offer, thus reducing your immediate return.

- Fees and Costs: Review any associated fees such as legal costs, processing fees, or commissions that might affect your net gain from the sale.

- Reputation of Buyer: Conduct thorough research on the buyer’s credentials and reputation. Trustworthy buyers should have a history of fair dealings and positive customer feedback.

- Payment Terms: Understand the payment structure of the offer. Clarify whether the payment will be a lump sum or instalments, and ensure you are comfortable with the proposed terms.

- Impact on Future Finances: Consider how the sale might affect your long-term finances, including potential tax implications or loss of future income.

- Tax Obligations: It is crucial to be aware of any tax responsibilities that arise from the sale. Consult a tax professional to clarify how the transaction may impact your tax situation.

Evaluating these elements provides a solid foundation for making a well-informed decision regarding the sale of your structured settlement.

“An informed decision today can prevent financial difficulties tomorrow.”

Understanding the ramifications of your choice is vital. Selling a structured settlement can yield immediate cash but may also result in future financial instability if not carefully considered. Engaging with financial advisors or legal professionals can offer additional insights, ensuring that your decision is not only beneficial in the short term but also sustainable in the long run.

When considering structured settlement money , it’s essential to understand its role in securing long-term financial stability. This type of compensation provides a steady income stream over time, which is especially beneficial for those recovering from injuries. However, individuals sometimes find themselves needing immediate funds, leading to discussions around the option to cash in structured settlements , allowing for a lump-sum payment that can address urgent financial needs.

In the realm of personal finance, cash in structured settlements has emerged as a viable solution for those looking to access their funds sooner rather than later. This process can be particularly appealing for individuals who prefer the flexibility of immediate cash over a long-term payment plan. Understanding the implications of structured settlement money can empower individuals to make informed decisions regarding their financial future.